RAFAEL GOMEZ DE PARADA / Admistration and Finance of Sacyr Services

This is a long-standing debate that has propagated notably in the past few years. In the 2017 World Economic Forum, projections were presented indicating that in 2025, close to 50% of jobs will be done by robots, which would entail strong job destruction and an increase in the public deficit for developed economies, meaning greater unemployment and less government revenue to pay for retirement pensions. Some relevant figures like Bill Gates, Elon Musk, or Economy Nobel Prize winner Robert Schiller, raised their voices backing a proposal with a similar argument to José María Álvarez’s, UGT Secretary-General, who in 2016 asked that “robots pay to the social security system for all workers that they keep from being employed in the companies”.

In reality, this debate should revolve around innovation itself: should technological advances be levied? This debate has revolved around robots, which we imagine to be human-like thanks to cinema or protocol androids we sometimes see in fairs and expos, but “the job-stealing machine” is as old as the First Industrial Revolution, and we are at the fourth now. Bill Gates himself said that there is a lot of talk about taxing robots, when it should refer to process automation, to anything that machines do more quickly, efficiently, and safely than people would.

Steam engines, harvester machines, and tractors, robotized automobile assembly lines, even computers, or practically any technological advance that we can think of have ended up replacing people’s jobs with machines. However, this debate was not as commonplace then.

In a group like ours, we can find plenty of activities in which business applied technological innovation has contributed to reducing monotone task jobs or jobs with high unpleasantness or accident rates.

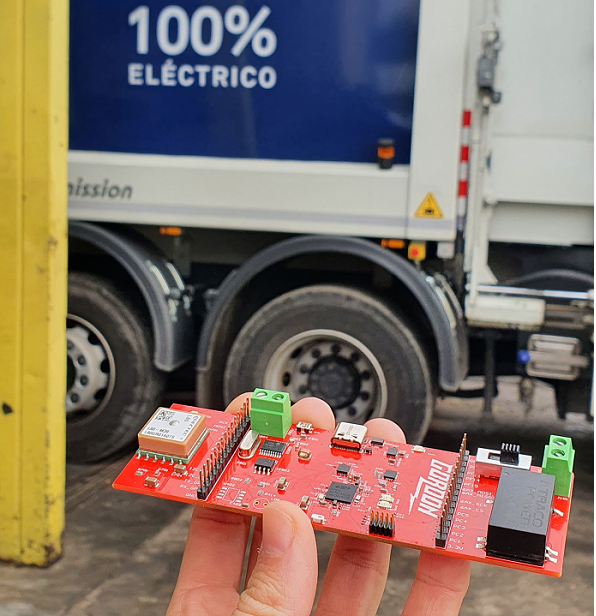

At Valoriza Medioambiente’s waste treatment plants, we use automatic dividers that combine several technologies, replacing manual waste triage workers, monotonous, unmotivating jobs in which the worker is exposed to odors, loudness, and unpleasantness. Side loader garbage trucks have reduced the number of people necessary to complete waste residue collection routes from three to one.

At Sacyr Concesiones, license plate or card readers that automatically open barriers have replaced jobs in toll-booths. At Sacyr Engineering and Infrastructures, tunneling machines, road rollers or modern construction techniques have not only reduced human job posts, but also accident rates.

The benefits of robots and automation are evident: they improve process efficiency, deadline times are shorter, and increase competitiveness, but at the same time, they create new jobs, so I believe we cannot go against progress in this debate. Applying this sort of tax is disputable for several reasons:

Robots will never pay taxes in the same way that they would never benefit from pensions or public services.

These taxes would be paid by companies, which in turn affect citizens that use robot-designed products or computers, same as today. This is a production tax, or more specifically, a tax on production processes.

Countries with the highest automation process rates like Japan, Germany, or South Korea, with rates close to 300 robots per 10,000 workers, have some of the lowest unemployment rates in the world. Hence, the association robots-job destruction does not hold.

In summary, a tax on robots would be a tax on innovation and an obstacle to private or company initiatives.